KYC needs for different use cases

Rigour offer KYC api integrations through its partner agency for use cases ranging from Lending,Employee verification, Account opening, E-commerce among others

PAN Verification

PAN ID or Tax ID Verification of Customers with Face match

2-way Video KYC

2-Way video based KYC for Customer id check

Company Verification

Company ID check like Corporate Identity Number, PAN, GST

Bank Records Verification

Check Bank Account Statements of Customers

Liveness Check

Unassisted user video call for customer Liveness check

Credit Bureau Verification

Bureau integration for real-time Customer credit report pull

Document E-signing

Electronically Sign Legal Documents using Aadhaar E-sign or equivalent

Aadhaar Verification

Verify Aadhaar number of customers

ID Data Masking

Store id data of customers in masked format

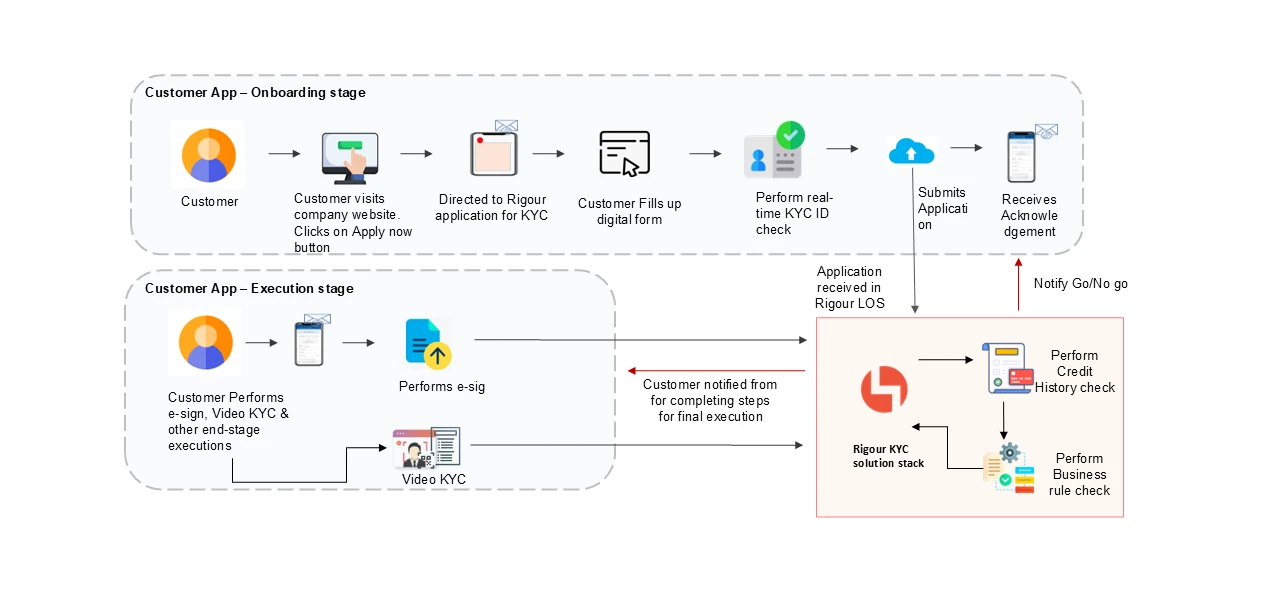

Integration with Rigour stack

We provide a seamless integration of KYC solutions embedded to our Lending & Ecommerce products

Hasslefree & Paperless Customer onboarding

With short and clear user journeys, drop-off rates are minimized. Move to a Customer self-service model, at the same time delighting them with intuitive steps.

- Simplify the user flow with smooth biometric

- Instant response to User if KYC completed

- Reduce Operational costs & human errors